The Bank of England‘s help with the markets has finished today (see 4.04 pm post).

But what have today’s events done to the markets?

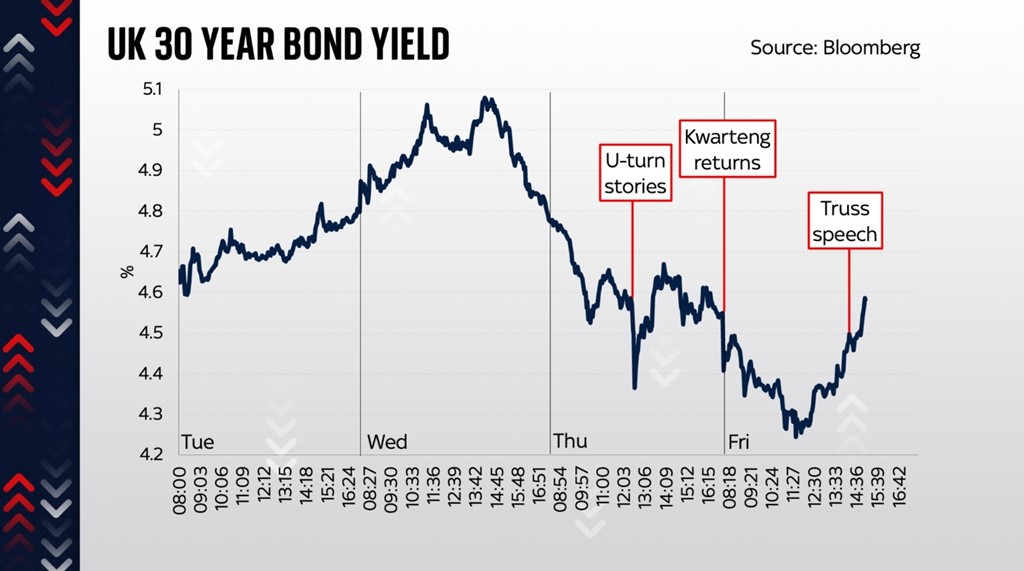

As Sky News business presenter Ian King explained: “30-year-gilts spiked earlier this week – hitting 5.1%, the highest level since 2002.

“That was on the back of comments made by Andrew Bailey, the governor of the Bank of England overnight on Tuesday that said pension funds only had three days in which to sort this issue out with today being the final deadline.

“The Bank started buying gilts more heavily on Wednesday and Thursday.

“You can see there on the chart the rumours in the middle of yesterday that the government was going to have to U-turn further on its mini-budget.

“And then we had rumours Kwasi Kwarteng was going to go – so you saw yields fall very, very sharply.

“They fell to as low as 4.1% this morning – a colossal move in terms of the scope of these things from 5.1% on Wednesday.

“Then we had confirmation that Mr Kwarteng had resigned – or been sacked – and you saw Liz Truss speak.

“And as you can see, gilt yields have risen all day long – which is not particularly encouraging.”

The higher the bond yield is, the more the government is going to have to pay for borrowing money.

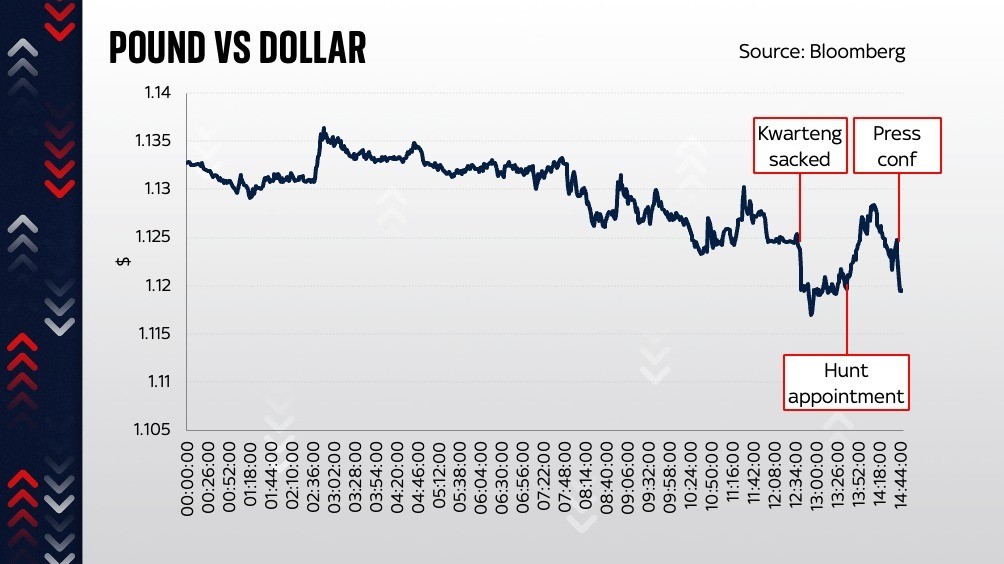

The pound has also been tumultuous today – falling with Mr Kwarteng’s sacking, rising on Mr Hunt’s appointment, and falling on Ms Truss’s press conference.