Chairman of the newly constituted Board of Trustees for the Social Security and National Insurance Trust (SSNIT), Nana Ansah Sasraku III, has committed to providing strategic direction to the Trust by leveraging collective expertise to drive growth, sustainability, and excellence in service delivery.

Nana Ansah Sasraku III noted that a roadmap for the Trust will be provided to safeguard the Scheme’s sustainability and ensure that it continues to meet its obligations to its valued members. He acknowledged the magnitude of the task ahead and expressed the Board’s readiness to deliver.

“We know that the task before us is immense. But what greater responsibility is there than securing the retirement incomes of the very people who built our nation? And what greater task is there than ensuring that after years of service, the Ghanaian worker can rest, assured that their future is safe? Yes, we are fully aware of the magnitude of the work ahead. But we are prepared, united and committed to ensure that the Trust’s resources are managed with integrity, prudence and foresight to secure the future of contributors and beneficiaries,” he said.

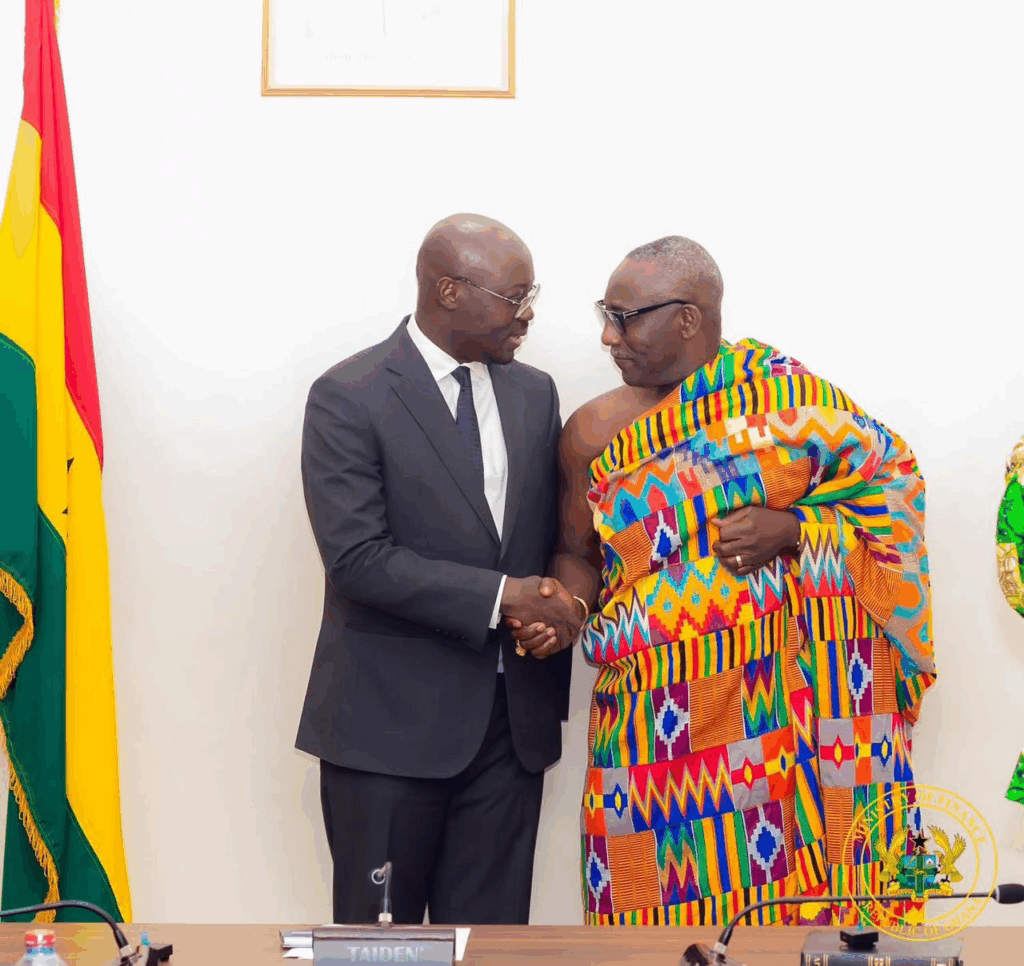

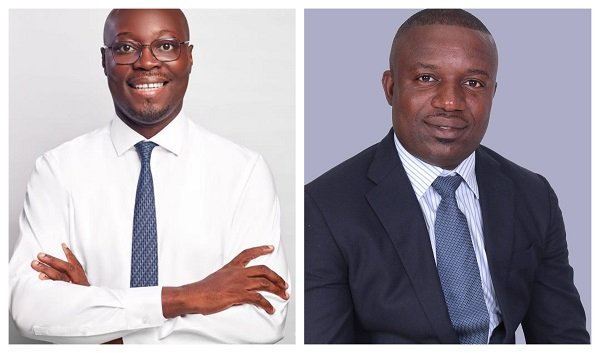

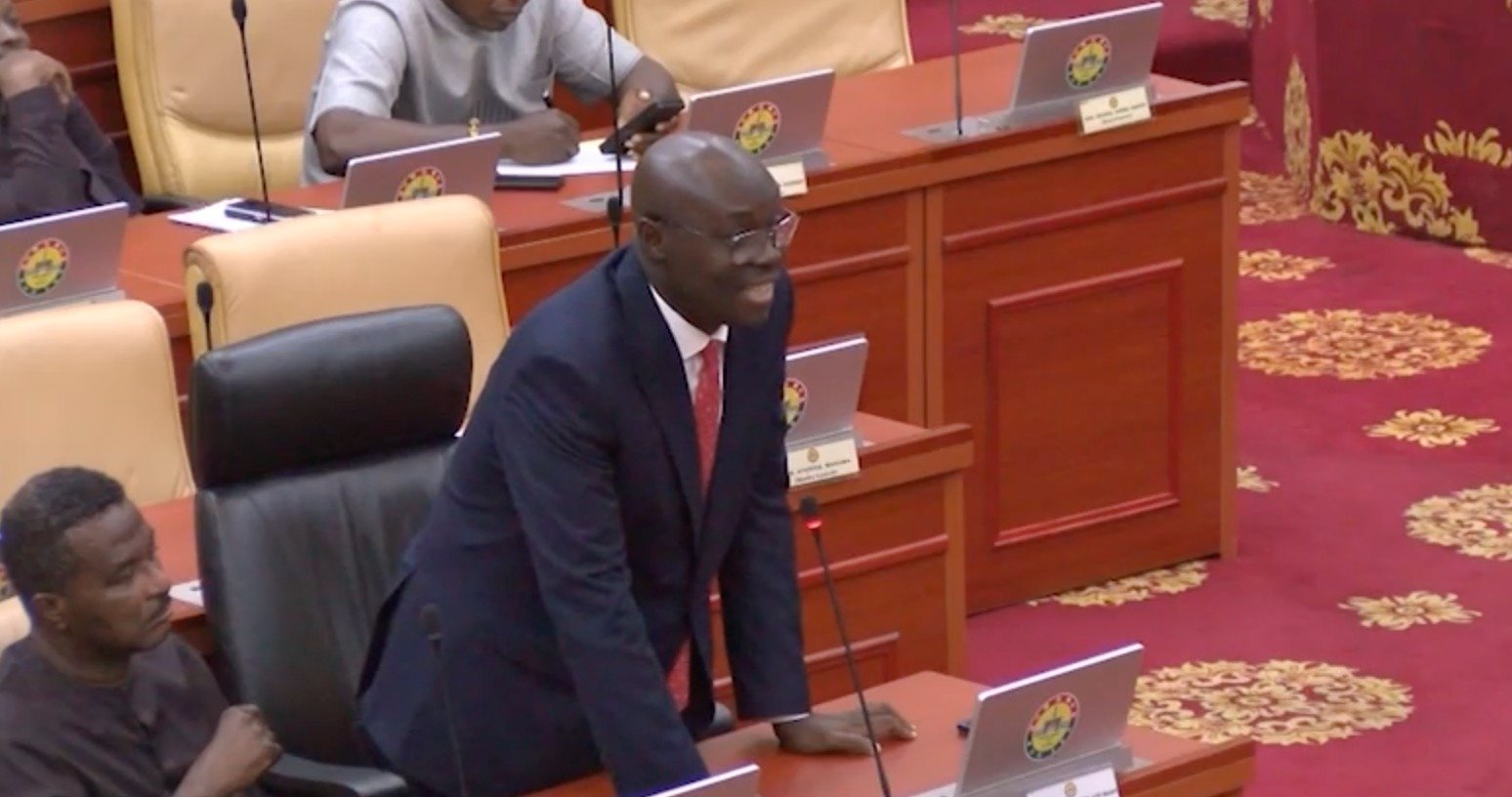

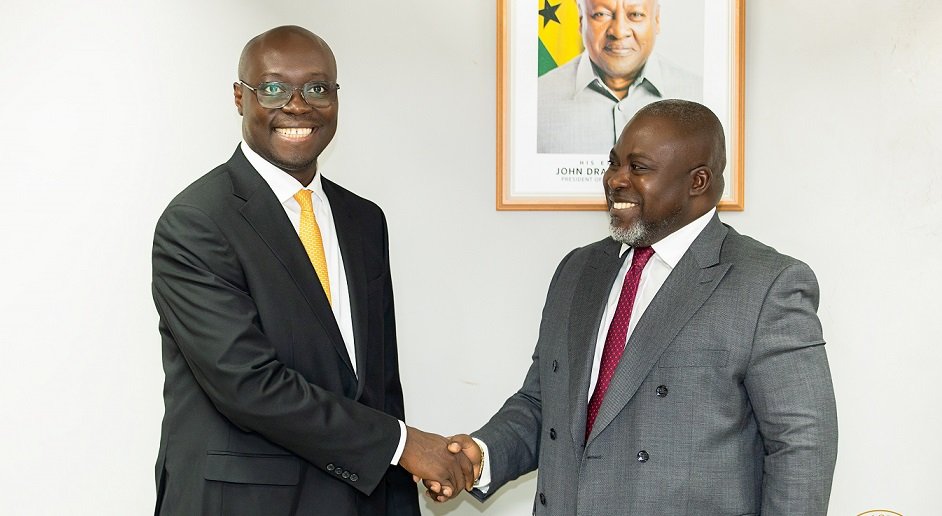

He made the remarks following the inauguration of the new Board of Trustees on Tuesday, June 3, by Finance Minister Dr. Cassiel Ato Forson, who called for prudence, integrity, and transparency in the management of Ghana’s pension funds.

Dr. Forson, in his address, noted the vital national importance of SSNIT, reminding the board that it is an institution “we will all need one day—when we retire.”

He warned against any attempts to sell state assets to politically connected individuals as he questioned some of SSNIT’s past investment decisions

“Please don’t sell state assets to politicians. The President will not accept it, and as your sector Minister, I will be the first to oppose it.”

He stressed that the people of Ghana have entrusted their future into the board’s hands, and therefore, their actions must reflect the weight of that responsibility.

The sector minister charged the new board to chart a new course and let their actions reflect the weight of the responsibility the people of Ghana have entrusted to them.

In May 2024, Member of Parliament for North Tongu, Samuel Okudzeto Ablakwa, lodged a formal petition with the Commission on Human Rights and Administrative Justice (CHRAJ) to investigate allegations surrounding the sale of six hotels namely, Labadi Beach Hotel, La Palm Royal Beach Resort, Elmina Beach Resort, Ridge Royal Hotel, Busua Beach Resort, and the Trust Lodge Hotel.

The Trust decided to sell a 60% stake in its hotels to Rock City Hotel owned by the Food and Agriculture Minister, Dr Bryan Acheampong. In response, Ghanaians demonstrated peacefully through the streets of Accra, compelling authorities to halt the planned sale.

The then-Minority in Parliament called on former President Akufo-Addo, who was president at the time, to instruct the Social Security and National Insurance Trust (SSNIT) to halt the sale, including several state officials who shared the same sentiments.

Later in July 2024, SSNIT eventually announced that it had halted the sale process following significant opposition from stakeholders. The private investor involved, Brian Acheampong’s Rock City Hotel, also withdrew from the transaction.

Former Minister for Employment, Labour Relations, and Pensions Ignatius Baffour Awuah reported that SSNIT’s total assets under management had seen substantial growth, increasing from GHS15.2 billion in December 2016 to GHS71.69 billion by March 2024. This, he said, represented a remarkable 350% increase over a seven-year period.