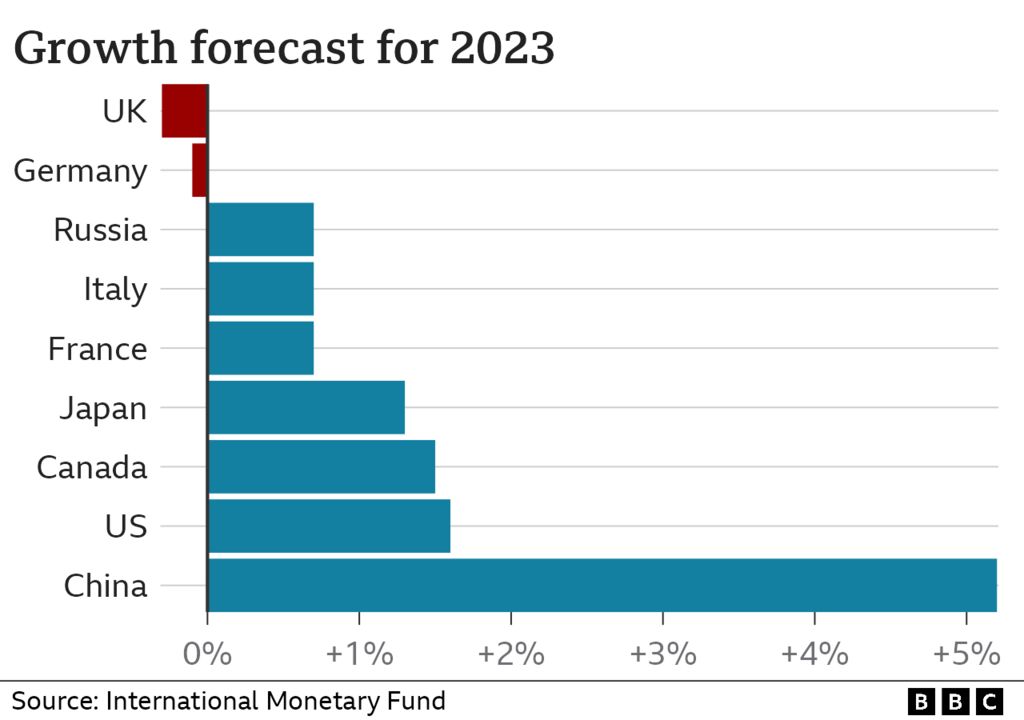

The UK is set to be one of the worst performing major economies in the world this year, according to a forecast.

The International Monetary Fund (IMF) says the UK economy’s performance in 2023 will be the worst of the G7 richest nations.

But it now also sees it as the worst performing of the wider G20 group, which includes sanctions-hit Russia.

It now predicts the UK economy will shrink by 0.3% in 2023, before growing by 1% next year.

It comes as the world economy continues to recover from the energy and pandemic shocks.

But the IMF now fears a “rocky road” from pockets of fragility in the global financial system since a series of bank failures around the world.

The IMF had already forecast that the UK would experience a mild downturn this year and be bottom of the pile of the G7 group of major nations, which it topped last year during the pandemic rebound.

The G7 group is made up of Canada, France, Germany, Italy, Japan, the US and UK.

While many forecasters think the chances of a recession are declining, the IMF still predicts the UK will shrink this year, alongside Germany.

The IMF also released a forecast for all the world’s economies, which showed the UK is predicted to be the worst performing of the wider G20 group of countries, which includes India, China and Russia.

IMF researchers recently pointed to Britain’s exposure to high gas prices, rising interest rates and a sluggish trade performance as reasons for the slowdown.

The new forecasts come against the backdrop of a world economy that continues to recover from both the pandemic and the Ukraine war energy shock.

But the body said there were concerns about the wider impact of recent fragility in global banking markets.

In March, Swiss banking giant Credit Suisse was taken over by its rival UBS. A number of US banks had already gone under earlier in the month, sparking fears of another financial crisis.

The IMF now expects global growth to fall from 3.4% in 2022 to 2.8% in 2023, before rising slowly and settling at 3% in five years’ time.

But it warned that if there is more stress in the financial sector, global growth could weaken further this year.

Rate predicted to fall

Separately, the IMF said it expects real interest rates – which take into account inflation – in major economies to fall to pre-pandemic levels because of low productivity and ageing populations.

Central banks in the UK, the US, Europe and other nations have been increasing interest rates to combat the rate of price rises, otherwise known as inflation.

In the UK, inflation is at its highest for nearly 40 years because of rising energy prices and soaring food costs. In response, the Bank of England has been raising interest rates, and last month increased them to 4.25%.

However, in a blog the IMF said that “recent increases in real interest rates are likely to be temporary”.

It added “When inflation is brought back under control, advanced economies’ central banks are likely to ease monetary policy and bring real interest rates back towards pre-pandemic levels.”

The IMF did not say, however, exactly when interest rates were set to fall back to lower levels.