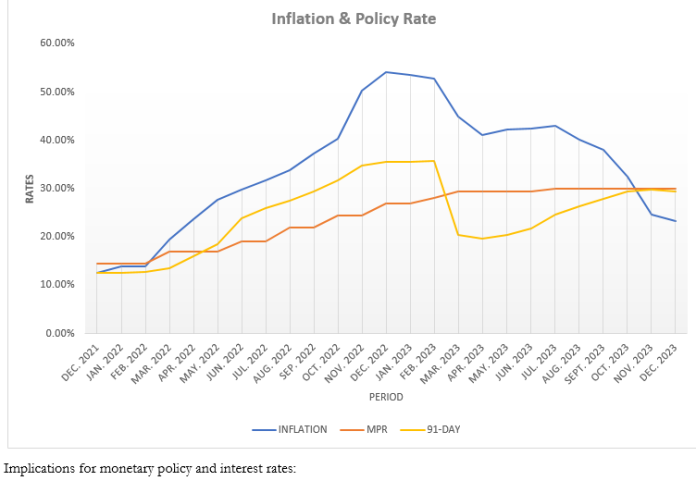

In response to escalating geopolitical tensions impacting oil prices and a year-end consumer inflation rate of 23.2 percent, the Bank of Ghana Monetary Policy Committee (MPC) is poised to maintain its ‘tighter-for-longer’ policy stance until inflation is securely anchored.

This strategic move reflects the central bank’s commitment to navigating economic uncertainties and fostering stability in the face of external pressures.

In the year 2023, consumer inflation witnessed a significant decline, registering a notable drop from 30.4 percent to close the year at 23.2 percent.

This surpassed both the government’s target of 31.3 percent and the IMF‘s central forecast of 29.4 percent.

Despite this positive trend, inflation persists at elevated levels when compared to the medium-term target of 8±2 percent.

The most recent projections from the central bank signal an ongoing disinflationary process, backed by a resilient monetary policy, a stable exchange rate, and the effects of base drift.

The central bank underscores its dedication to vigilance in closely monitoring potential risks that could impact the ongoing disinflation process.

Addressing recent occurrences since the last committee meeting, increased tensions in the Middle East and disruptions in the Suez Canal present additional challenges. According to a Reuters report, air and sea strikes by the United States and Britain on Houthi targets in Yemen led to a 3 percent surge in oil prices.

The Suez Canal, responsible for approximately 12 percent of global trade, has already experienced weeks of disruptions, causing a 1.3 percent decline in global trade from November to December 2023 and impacting businesses worldwide.

Brent crude futures were up US$2.21, or 2.9 percent, at US$79.62 a barrel at 13.50 GMT; while U.S. West Texas Intermediate crude futures climbed US$2.13, or 3 percent, to US$74.15.

The main transmission conduits for these global uncertainties will be through energy prices, exchange rates, inflation and interest rates, especially if the Middle East conflict expands to involve Iran.

Gita Gopinath, First Managing Director-IMF, warns central banks about the potential challenges in addressing inflation trajectories, especially in the face of financial stresses. She emphasises the need for vigilance and preparedness in navigating the complex economic landscape, considering the possibility of a stagflationary environment.

“If inflation proves to be stubborn or escalates due to unforeseen shocks, it may necessitate higher interest rates for an extended period – or even lead to rate increases. This could result in a situation where there is an inflation problem while simultaneously experiencing a significant slowdown in economic growth. Such a scenario is known as a stagflationary environment, and it should not be dismissed as a possibility. Therefore, there is a need for vigilance and preparedness in addressing potential challenges in this complex economic landscape,” she said.