The Bank of England’s governor has ruled out extending its bond-buying support for pension funds beyond Friday’s deadline, prompting a dramatic fall in the value of the pound.

Andrew Bailey told an event in Washington that funds had “three days left… to get this done” after a series of interventions to support the “dysfunctional” market in the wake of the wider meltdown over the government’s mini-budget.

The latest action, on Tuesday, saw the Bank snap up index-linked gilts, government bonds with interest payments in line with inflation.

They are heavily used by pension funds.

The Bank had already been buying up long-dated gilts – a type of government bond that make up a large proportion of pension pots – to steady market jitters.

They saw yields – the rate demanded to hold government debt – shoot up as pension schemes tried to raise hundreds of billions through firesales of government and corporate bonds to meet cash calls – the latest coming from providers of so-called liability-driven investment strategies.

They are demanding funds put up more money to support new and older hedging positions.

Mr Bailey told an event organised by the Institute of International Finance that the intervention must be temporary.

Please use Chrome browser for a more accessible video player

Are we set for another era of austerity?

“We have announced that we will be out by the end of this week. We think the rebalancing must be done.

“And my message to the funds involved and all the firms involved managing those funds: You’ve got three days left now. You’ve got to get this done.”

Industry body the Pensions and Lifetime Savings Association had earlier urged the Bank to extend the bond-buying programme until 31 October – the new date for the publication of the government’s debt plan – at least.

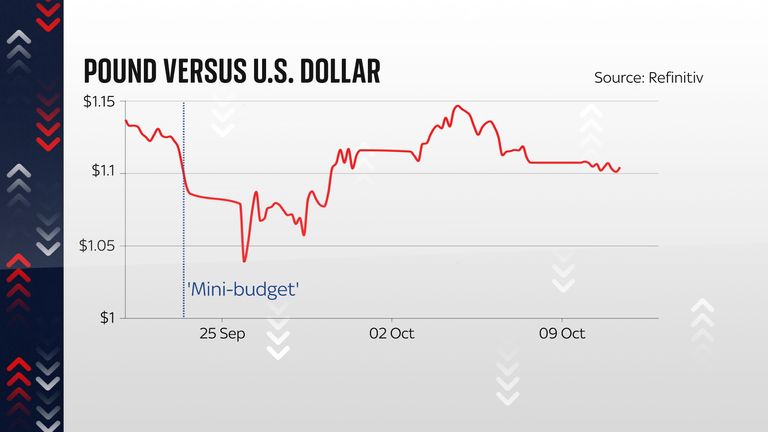

Mr Bailey’s clear stance on the issue saw the pound, which had been trading higher on the day versus the dollar earlier, sink by more than one and a half cents to below $1.10.

What on earth is happening in UK markets?

This is starting to look a little… unnerving.

The government bond market is – in the UK and elsewhere – best thought of as the bedrock of the financial system.

The government borrows lots of money each year at very long durations and these bonds are bought by all sorts of investors to secure a low but (usually) reliable income over a long period of time.

Compared to other sorts of assets – such as the shares issued by companies or for that matter cryptocurrencies – government bonds are boring. Or at least, they’re supposed to be boring.

They don’t move all that much each day and the yield they offer – the interest rate implied by their prices – is typically much lower than most other asset classes.

But recently the UK bond market (we call them gilts as a matter of tradition, short for gilt-edged securities, because in their earliest embodiment they were pieces of paper with golden edges) has been anything but boring.

On Monday the Bank announced a potential doubling of the amount it was willing to spend every day on long-dated gilts.

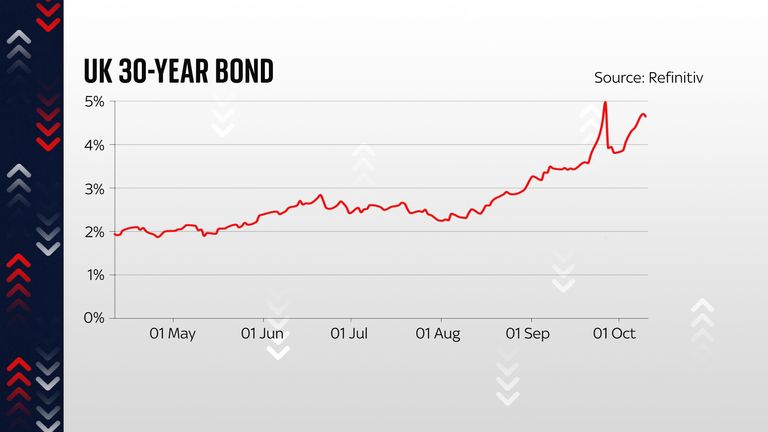

Gilt yields, the interest rate payable on government bonds, rose on Monday, near the 5% highs of 27 September, the day before the Bank made its first intervention.

They fell when news of the latest operation was announced but long-dated yields later rose higher again.

That took place when the Bank revealed it had bought £1.947bn of index-linked bonds on Tuesday, adding that it had rejected £466.9m of offers to sell to the central bank.

It also bought up £1.363bn in long-dated bonds – also well below the £5bn possible.

The yield on 30-year bonds rose back to 4.8% for a short time, having been down at 4.4% around lunchtime.

The benchmark 10-year yield remained around the 4.4% level.

“Things seemed calmer again today,” Mr Bailey told the event.

“We will see,” he added.

The Bank announced on 28 September a temporary and emergency buying programme of long-dated gilts that are to be repaid in 20 to 30 years time, in the wake of chancellor Kwasi Kwarteng’s mini-budget announcement.

Bond buying period due to end on Friday

Market turmoil that stemmed from the mini-budget led to the unprecedented intervention from the regulator to prevent part of the pension market collapsing as the cost of interest on gilts surged.

Russ Mould, investment director at AJ Bell, said of the scheme’s expansion before Mr Bailey’s remarks: “The Bank of England hopes to avoid a crisis in the market by being a willing buyer of bonds from pension funds who are under pressure.

“These pension funds will welcome today’s move, but whether the broader market shares the same enthusiasm remains to be seen.

“The key sticking point is that the support measures are only scheduled to last until Friday.

“Will that be long enough, or will the Bank of England extend the support scheme? Extending it could go one of two ways – the market either applauds the move and breathes a sigh of relief or it gets even more worried, thinking that the extra time suggests the crisis is more severe than originally thought.”

Source: SkyNews.com