The deputy minister of trade and industry, Michael Okyere Baafi has refuted claims that the government’s implementation of three revenue taxes will cause businesses to fail.

According to him, the government’s intention is not to cripple businesses but to tax businesses that have expanded over the years to rake in more revenue domestically.

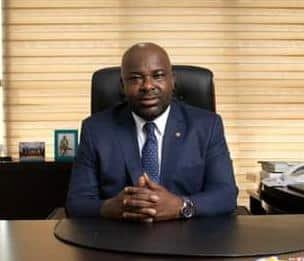

In an exclusive interview with GhanaWeb’s Ernestina Serwaa Asante at the AfCFTA Business Forum held in Capetown South Africa, Mr Baafi said the taxes will help government embark on infrastructural projects for the benefit of Ghanaians.

The three new revenue bills passed by parliament; Income Tax Amendment Bill, Excise Duty Amendment Bill, and Growth and Sustainability Amendment Bill aim at raking in about GH¢4 billion if the bill is implemented.

“The intention of government is not to cripple or sabotage businesses. That’s not what government has in mind. Government’s interest is to encourage people to do business and also when they do businesses and when they grow, those businesses are supposed to pay more taxes to government so that we can be able to undertake projects like very good infrastructural projects like roads, other things that will benefit car users and users of social services in the country,” he told GhanaWeb Business.

He stressed that taxation “[It] is a normal way for government to generate more revenue domestically.”

The Growth and Sustainability Levy is expected to raise approximately GH¢2.216 billion in 2023, while the Income Tax (Amendment) Bill, 2022 which amends the Income Tax Act, 2015 (Act 896) is expected to yield revenues of approximately GH¢1.29 billion.

The Excise Duty (Amendment) Bill, 2022 amends the Excise Duty Act, 2014 (Act 878) and is expected to yield approximately GH¢455 million.

But some Ghanaians including the business community have tongue-lashed parliament for passing the three revenue bills.

They have called on President Akufo-Addo to not assent the bill into law.

They explained proper stakeholder engagement with the business community for there to be a consensus.