In 1947, the idea to establish a national bank with central banking functions was conceived in the then Gold Coast, now known as Ghana. Today, that financial institution is none other than GCB Bank, making it arguably the oldest indigenous bank in the country.

The formation of GCB Bank was driven by proposals from prominent politicians in the Gold Coast. Subsequently, in 1949, a select committee of the Legislative Assembly was appointed to investigate the establishment of a national bank with exclusive central banking functions. In 1951, Sir Cecil Trevor was commissioned by the government to examine the possibility of creating a state-owned commercial bank that would finance development projects and act as a reserve bank providing clearing house services.

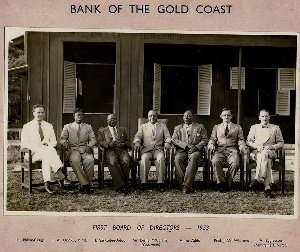

Following his recommendation, the Bank of the Gold Coast was established in 1952 under the Bank of the Gold Coast Ordinance. It officially commenced operations in 1953 as GCB Bank. Alfred Engleston was appointed to lead the Bank at that time. Initially, the Bank operated in two sections, with one becoming the Bank of Ghana, functioning as a bank of issue and destined to become a complete central bank. The other section was named Ghana Commercial Bank and was intended to evolve into the largest commercial bank with a monopoly on the accounts of public corporations.

GCB Bank started with 27 employees in its first branch, primarily catering to Ghanaian traders, farmers, and business people who faced challenges obtaining financing from expatriate banks at the time.

Soon after Ghana gained independence in March 1957, Alfred Engleston was appointed as the first Governor of the Bank of Ghana. Under his leadership, the Bank of Ghana assumed responsibility for managing the currency and introduced the cedi as the country’s first national currency in July 1958, replacing the old West African currency notes.

In line with Ghana’s independence, the Bank of the Gold Coast was rebranded as Ghana Commercial Bank, taking on the role and functions of government bankers, while assuming financial management of most government departments and public corporations.

While wholly-owned by the Government of Ghana, the shares of the Bank of Ghana were listed on the Ghana Stock Exchange in 1996 when government shareholding stood at 51.17 percent. Presently, government ownership of Ghana Commercial Bank stands at 21.36 percent, with institutional and individual holdings accounting for 78.64 percent, according to the Bank of Ghana.

Between 2013 and 2014, Ghana Commercial Bank underwent a rebranding exercise, resulting in its current name, GCB Bank Limited. It now serves the banking needs of large corporations, parastatal companies, small and medium enterprises, as well as individuals.

Over the years, GCB Bank has experienced remarkable growth, expanding from a single branch in the 1950s to approximately 150 branches and 11 agencies spread throughout the country.