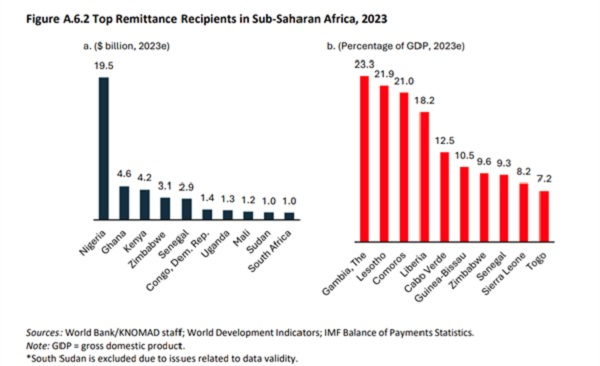

In 2023, remittance flows in Sub-Saharan Africa reached US$54 billion, with Ghana emerging as one of the major recipients, ranking second highest in the region according to the latest World Bank Migration and Development Brief.

During this period, remittances to Ghana amounted to US$4.6 billion, placing it just behind neighboring Nigeria which received US$19.5 billion.

Although slightly lower than the US$4.7 billion recorded in 2022 and US$4.5 billion in 2021, these funds have been pivotal in stabilizing Ghana’s economic landscape amid a marginal 0.3 percent regional decline from the previous year.

Ghana reported a current account surplus in the third quarter of 2023, bolstered by robust remittance growth.

These financial transfers have played a crucial role in alleviating challenges such as food insecurity, droughts, supply chain disruptions, floods, and debt servicing difficulties, exacerbated by global geopolitical tensions including the Russian invasion of Ukraine and the Israel-Gaza conflict.

In contrast to the volatile nature of foreign direct investment (FDI) flows, remittances have proven to be a more reliable source of foreign exchange for Sub-Saharan Africa. In 2023, remittances to the region exceeded FDI flows by nearly 1.5 times, totaling US$38.6 billion. Major recipients included Nigeria, Ghana, Kenya, and Zimbabwe.

The increasing reliance on remittances in Ghana has become evident, providing essential income for many households and serving as a critical buffer against economic uncertainties while supporting the country’s current account balance.

“Remittance flows to the region supported the current accounts of several African countries that were dealing with food insecurity, drought, supply chain disruptions, floods, and debt-servicing difficulties,” the report emphasized, highlighting the stabilizing effect of these funds.

The recent actions taken by the Central Bank of Nigeria (CBN) to unify the foreign exchange market and implement new operational methods for financial institutions could impact Ghana. These regulatory adjustments are aimed at fostering competition and reducing transaction expenses, potentially benefiting Ghanaians who receive remittances from Nigeria.

Nevertheless, the persistently high cost of remittances remains a concern. In Sub-Saharan Africa, senders paid an average fee of 7.9 percent to transfer US$200 in the fourth quarter of 2023, up from 7.4 percent in the same period of 2022. Costs varied widely, with certain routes charging as much as 36 percent. This highlights the urgent need for more affordable and efficient remittance channels.

Regional Dynamics and Future Outlook

Kenya, a significant recipient of remittances, has demonstrated promising growth with a 21 percent increase in remittance inflows during the first four months of 2024 compared to the same period in 2023. This growth is primarily fueled by contributions from the United States, Canada, the United Kingdom, Switzerland, and Italy, underscoring strong connections between the diaspora and their home countries.

Looking forward, remittance growth across Sub-Saharan Africa is expected to rebound modestly, transitioning from a -0.3 percent decline in 2023 to a projected increase of 1.5 percent in 2024. However, several challenges lie ahead, including potential economic slowdowns in developed nations, escalating conflicts, and climate-related risks.

Migration Trends and Their Impact

Conflicts within Sub-Saharan Africa, particularly in Sudan, have led to significant cross-border population movements. The region is now hosting millions of internally displaced persons and refugees, with substantial numbers moving to neighboring countries. This migration trend underscores the interconnectedness of African economies and the importance of stable remittance flows.