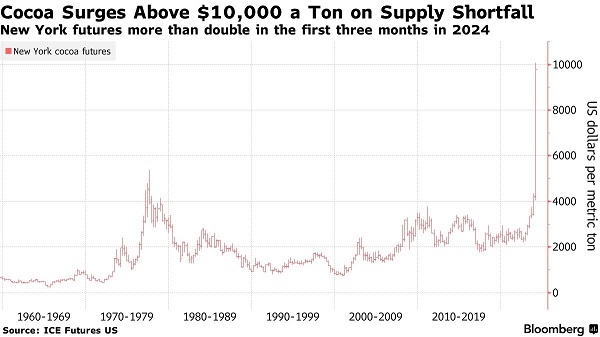

In the aftermath of a steady ascent spanning two years, the price of cocoa beans has surged dramatically this year, with futures contracts more than doubling in just three months, reaching a level in March twice as high as the previous record.

This escalation has its origins in the fields of small West African farms but is also influenced by climate change and the intricacies of the futures market.

The recent spike has been fueled in part by financial instability, a common occurrence when commodity prices rise rapidly, overwhelming strategies designed to mitigate such volatility.

The inevitable outcome is likely to be pricier chocolate, possibly in smaller portions. Even if prices retreat from their current peaks, they are expected to remain elevated for the foreseeable future. Economists often assert that the solution to high prices is high prices themselves, as they can diminish demand, stimulate increases in supply, or both.

However, the cocoa situation illustrates the complexity of this concept in practice, given market intricacies and stubborn realities such as the lengthy gestation period of cocoa trees.

Current Status

Cocoa futures in both New York and London have reached unprecedented nominal dollar highs, surpassing the peaks observed in 1977 during another cocoa scarcity.

New York futures hit an intraday peak of $10,080 per metric ton on March 26 and have since remained above $9,500, while London beans traded above £8,000 per ton (approximately $10,000).

Prior to this surge, New York futures had predominantly stayed below $3,500 since the 1980s.

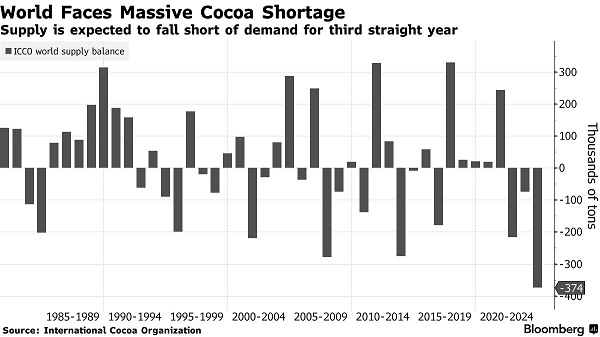

The surge in prices is driven by an all-time supply crunch, with the world projected to experience a third consecutive year of deficits.

According to the International Cocoa Organization, production is anticipated to fall short of demand in 2024 by 374,000 tons, while manufacturer Barry Callebaut predicts a gap of approximately 500,000 tons, equivalent to about a tenth of the global market.

How we got here

Unlike most crops grown for global commodity markets, cocoa is produced not by large scale plantations but by small farmers, many in West Africa, which has dominated the trade for decades. Ivory Coast and Ghana are still forecast to supply 53% of the world’s cocoa in the current season — a share that was even higher before current crop issues. Here are some of the factors that have been driving down production:

Both rain and drought have been more severe than usual in West Africa

Swamped fields have worsened the spread of diseases like black pod disease and swollen-shoot virus, which are rotting pods and killing trees, and the tree stock is also aging

The small farmers in Ivory Coast and Ghana have long been underpaid; since governments set prices in each country before each new growing season, producers have yet to profit from the current rally

Low pay has hampered farmers’ ability to invest in improvements and fend off disease, limiting how much cocoa their trees can yield

What else is driving the price spike

The record cocoa shortage produced by those factors can account for the generally higher trend in prices, and Citi Research analysts had pointed last month

to a trading range between $7,000 to $10,000 a ton. But the magnitude of the latest surge — which saw New York cocoa futures rise more than $1,000 during two sessions — has led market watchers to believe financial drivers are also at play.

This occurs because traders typically utilize the futures market to hedge risks associated with the physical market.

Sellers, holding cocoa inventory, anticipate price increases but safeguard themselves by placing bets on declining prices. If prices rise, their gains from the stockpiles outweigh the expenses incurred from these short positions.

Conversely, if prices decline and their inventory loses value, these short bets mitigate some of the losses.

Such hedging strategies prove effective when commodities fluctuate within a moderate range. However, sharp and unilateral market movements complicate matters due to the necessity for traders to provide collateral to cover their futures contracts.

If prices consistently rise and escalate significantly, the additional collateral requirements may become prohibitively expensive. Consequently, some traders opt to close their positions, which entails purchasing more cocoa contracts, further driving up prices.

To maintain market stability, the Intercontinental Exchange has implemented measures such as reducing the volume of cocoa that traders can purchase through the London exchange.

This entails a reduction in the delivery limit, decreasing from 75,000 tons in May to 50,000 tons in July, with further reductions to 25,000 tons for contracts starting from December onward.

What this means for consumers

Chocolatiers are doing all they can to offset higher costs — hiking retail prices, shrinking pack sizes, maximizing efficiency and pushing products with less cocoa. But those shifts are just the beginning: Companies hedge prices and secure supplies well in advance, so the impact of the new, record-high futures hasn’t fully trickled down to retail shelves yet. Chocolate makers are likely to see that inflation over six to 12 months, and then consumers will face it too, according to Bloomberg Intelligence.

The pinch will also be felt by chocolate processors and their workers. Plants in Ghana have been closed intermittently because of supply shortages. Major cocoa processors Barry Callebaut AG and Blommer Chocolate Co. have also said they would be shutting down facilities and laying off employees

Who’s winning, who’s losing

Higher prices are good in the long run for farmers, who have long been underpaid. But so far, growers in the world’s biggest-producing countries are also the ones missing out on the rally’s full profits. That’s because Ivory Coast and Ghana’s governments set cocoa prices based on sales made a year earlier.

Farmers in Ivory Coast are receiving 1,000 CFA francs per kilogram, while those in Ghana are getting 20,928 cedis a ton – both equating to about $1,600 per ton. Producers in Ivory Coast are pushing for more pay for the mid-crop harvest starting in April, but the country’s industry regulator has proposed keeping prices the same, Bloomberg reported.

Meanwhile, farmers in liberalized markets like in Brazil, Ecuador, Cameroon and Nigeria are ramping up production to take advantage of higher prices. Brazil and Cameroon are trying to double output by the end of the decade, while Ecuador is targeting 800,000 tons of output

by 2030 — an amount that could allow the nation to overtake Ghana to become the world’s second-largest producer, behind only Ivory Coast. But trees take time to grow, so it will be at least three years before new pods provide supply relief. European Union rules preventing the trade of products linked to deforestation could also limit acreage expansion for cocoa and crunch supplies in the world’s biggest chocolate-consuming region.

The longer term prospects

Supply isn’t likely to make a rapid recovery. The smaller mid-crop harvest in Ivory Coast that is just kicking off is expected to be weaker than last year, and some are already bracing for another deficit next season.

On the other side of the equation, expensive chocolate is already weighing on demand, prompting consumers to pick up less of it. Favorable weather could facilitate a quicker recovery in production. Governments in Ivory Coast and Ghana could also increase the amount paid to farmers. That would fund reinvestments in pesticides, fertilizer and labor to boost 2025 crop yields. New producers in Latin America and elsewhere, lured by high prices, will also start contributing to global supply in the years to come.