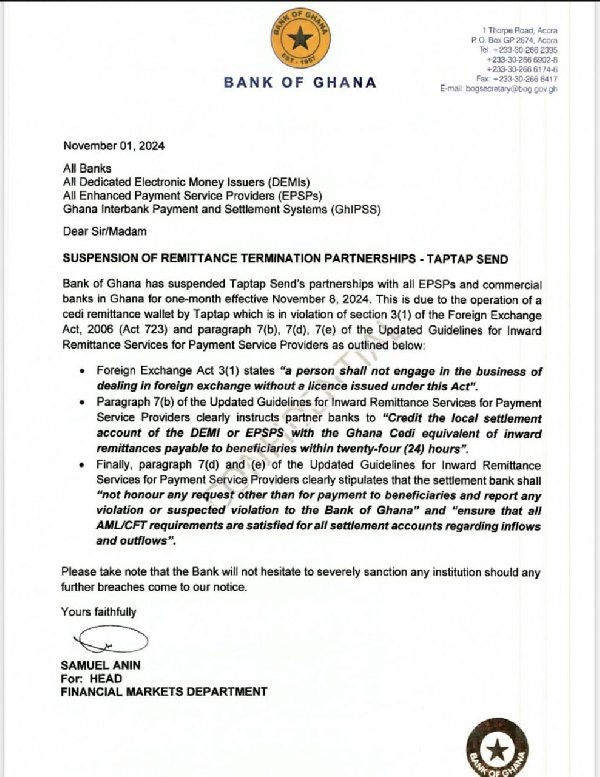

The Bank of Ghana has imposed a one-month suspension, effective November 8, 2024, on Taptap Send’s partnerships with payment service providers and commercial banks.

This action stems from Taptap Send’s operation of a cedi remittance wallet, which the BoG states breaches the Foreign Exchange Act of 2006 and regulations governing money transfer services.

The Bank’s statement pointed out that Taptap Send violated Section 3(1) of the Act, which prohibits unlicensed engagement in foreign exchange operations.

Quoting the law, the BoG emphasized, “A person shall not engage in the business of dealing in foreign exchange without a licence issued under this Act.”

In addition to this violation, Taptap Send failed to meet requirements set forth in the Updated Guidelines for Inward Remittance Services, which include timely crediting of local accounts and full compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) standards.

According to the Bank, “Paragraph 7(d) and (e) of the Updated Guidelines for Inward Remittance Services for Payment Service Providers” obligates settlement banks to enforce AML/CFT compliance and report any suspicious activity.

“Paragraph 7(d) and (e) of the Updated Guidelines for Inward Remittance Services for Payment Service Providers clearly stipulates that the settlement bank shall “not honour any request other than for payment to beneficiaries and report any violation or suspected violation to the Bank of Ghana” and “ensure that all AML/CFT requirements are satisfied for all settlement accounts regarding inflows and outflows,” the statement added.

The BoG underscored the importance of these regulations in maintaining the integrity of Ghana’s financial system, warning that further violations would result in more severe penalties.