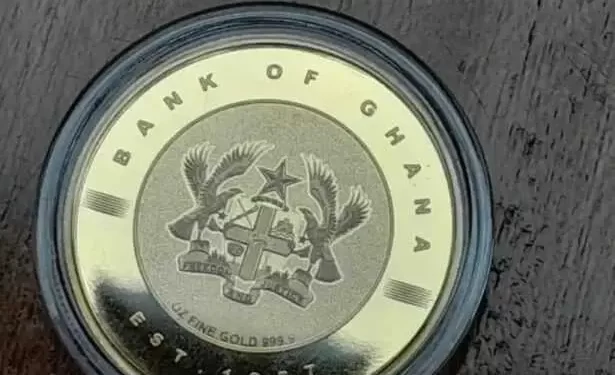

The Bank of Ghana (BoG) has unveiled the Ghana Gold Coin, a notable addition to the domestic gold program, providing Ghanaians with a fresh investment option.

This development arrives at a time when the cedi has weakened by 26% against key international currencies, as of September 2024.

The Ghana Gold Coin is designed to mop up excess liquidity, discourage the hoarding of dollars, and bolster the local currency. While it offers investors a chance to broaden their portfolios, it also carries inherent risks that should not be underestimated.

This article delves into the primary risks tied to investing in the Ghana Gold Coin and takes a closer look at its pricing structure to determine whether it is a prudent investment choice given the current economic conditions.

Gold Coin Pricing Mechanism and Investment Feasibility

Gold has traditionally been viewed as a safe-haven asset, especially during periods of economic instability. In 2024, international gold prices have surged by 12% year-to-date, reflecting robust demand for the metal.

The Ghana Gold Coin, which comes in three denominations—one-ounce, half-ounce, and quarter-ounce—will be available for purchase at commercial banks nationwide. Its price will likely be influenced by global gold market trends, though local factors such as market dynamics and the strength of the cedi are also expected to impact its pricing.

Price Volatility

Although gold is often seen as a stable long-term investment, it is still subject to short-term price swings. Investors in the Ghana Gold Coin should be aware of potential volatility in both the global gold market and the local currency.

One key consideration is whether the recent 12% rise in gold prices marks a peak. If global prices stabilize or fall, those buying the Ghana Gold Coin during this period of high prices could see their investment lose value.

Additionally, while gold can serve as a safeguard against inflation, its success as a hedge depends significantly on market timing. Should global gold prices fall and the cedi continue to depreciate, the Ghana Gold Coin may not provide the level of security investors anticipate, potentially leading to losses. Therefore, investors must carefully consider market timing and the relationship between international gold prices and the cedi’s value.

Cedi Depreciation Risk

One of the primary goals of the Ghana Gold Coin initiative is to support the cedi, which has experienced significant depreciation. However, the cedi’s value fell by 26% against major currencies in September 2024, which presents a substantial risk for investors. Even though holding gold is often seen as a hedge against currency depreciation, there is no guarantee that the Ghana Gold Coin will be insulated from these effects, particularly if global gold prices decline.

If the cedi continues to weaken, holding gold in any form could offer some protection, but it is important to note that any currency depreciation will also affect the purchasing power of Ghanaians who buy these coins. Therefore, while the gold coin could potentially serve as a store of value, the ongoing volatility of the cedi means that investors may need to weigh their options carefully.

Liquidity and Accessibility Risks

A major risk for investors in the Ghana Gold Coin is liquidity. The Bank of Ghana’s effort to absorb excess liquidity from the banking system presents a mixed outcome. While this move could help stabilize the cedi, it may also reduce liquidity in the secondary market for the coins. Investors should carefully assess how easily they will be able to sell their gold coins if they require fast cash.

Limited Market for Resale

Although the gold coin will be sold in commercial banks, there is no clear indication of how robust the secondary market for these coins will be. A lack of demand could lead to difficulty in reselling the coin at a favourable price. This poses a liquidity risk, particularly for those who may need to convert their gold investment back into cash quickly.

For an investment to be truly effective, it must be easily accessible, both in terms of purchase and resale. If the Ghana Gold Coin does not achieve widespread adoption, investors could find themselves holding an asset that is difficult to sell, locking up capital at a time when it might be needed most.

Demand-Driven Pricing

The viability of the gold coin largely hinges on local demand. If demand for the Ghana Gold Coin falls short, its price could remain flat or decline, reducing its appeal as an investment. Investors should be mindful that the success of this initiative is uncertain, and demand for the coin may vary, especially if more attractive investment options emerge in the future.

Economic and Institutional Stability

Another major concern for investors in the Ghana Gold Coin is the broader economic and institutional stability of the Bank of Ghana. The BoG has experienced significant financial difficulties in recent years, reporting a loss of GH₵60.9 billion in 2022 and a further loss of GH₵10.50 billion in 2023. This has led to questions about the central bank’s solvency and its ability to manage the economy effectively.

Bank of Ghana’s Insolvency

The financial instability of the BoG raises concerns about its ability to guarantee the value of the Ghana Gold Coin. If the central bank is technically insolvent, there is a risk that it may struggle to support the gold coin initiative in the long term.

This uncertainty could undermine investor confidence and limit the success of the program.

In addition to its financial losses, the BoG’s broader policy instability raises questions about the effectiveness of its monetary strategies. Investors must ask whether the gold coin initiative is a well-thought-out strategy or merely a stopgap measure to shore up confidence in the currency and the economy especially going into elections.

Uncertain Market Adoption

The long-term success of the Ghana Gold Coin depends on widespread adoption among local investors and the broader Ghanaian market. If the coin is not embraced as a popular investment option, the demand could be low, negatively impacting liquidity and resale value.

Although the BoG aims to absorb excess liquidity and reduce dollar hoarding, the question remains whether enough Ghanaians will view the gold coin as a viable alternative to more conventional investment options, such as fixed deposit or government bonds.

Additionally, the gold coin’s success will rely on how well it is marketed and how accessible it becomes to the average investor. The coins will be available through commercial banks, but if they are perceived as too niche or are not sufficiently promoted, the market demand may not reach the levels required to ensure a robust and active secondary market.

Competing Investment Options

In the current economic environment, investors have other options to consider beyond the Ghana Gold Coin. For instance, the Government of Ghana (GoG) has issued USD-denominated bonds maturing in 2027 and 2028, with interest rates of 2.75% and 3.25%, respectively. These bonds offer a fixed return over 4 to 5 years, providing a more predictable outcome compared to gold, which can be highly volatile.

Lower Yield, Higher Certainty

While the returns on GoG bonds are relatively low, they offer stability and predictability, which are attractive to risk-averse investors. By contrast, the Ghana Gold Coin may offer the potential for capital appreciation, but its value is subject to global gold price fluctuations and local economic conditions. For investors seeking a safer, more predictable investment, government bonds may be a better option.

Yield vs. Gold Returns

Investors seeking higher returns might be drawn to gold due to its potential for appreciation, especially given the 12% y-t-d increase in global prices. However, the return on investment (ROI) for gold is uncertain, and the risks associated with price volatility and currency depreciation must be factored into any decision.

Guarantee and Security Risks

Although gold itself is a valuable and tangible asset, the Ghana Gold Coin comes with no explicit guarantee. The coins will be packaged in a wooden story box, along with a transparent coin holder and a certificate of ownership. While this adds an official layer of security, it is still subject to the risks associated with the BoG’s financial health.

No Explicit Guarantee

Without a clear guarantee from the BoG or another financial institution, investors in the Ghana Gold Coin are exposed to the risk that their investment may not retain its value, particularly if the central bank is unable to stabilize the cedi or manage its financial losses effectively.

Monitoring Economic Indicators

Investors in the Ghana Gold Coin should also pay close attention to key economic indicators in both the local and global markets. Keeping an eye on global gold prices, cedi exchange rates, inflation figures, and the BoG’s policy decisions will help investors make informed decisions about whether to hold or sell their coins.

Conclusion

The Ghana Gold Coin presents a unique investment opportunity for Ghanaians looking to diversify their portfolios and protect their savings against currency depreciation and inflation. However, it also comes with significant risks, including price volatility, liquidity concerns, and the financial instability of the Bank of Ghana.

While gold can offer a hedge against economic uncertainty, investors must carefully weigh these risks and consider whether the Ghana Gold Coin is the right investment for their needs. The lack of an explicit guarantee, combined with the potential for further depreciation of the cedi, makes this a high-risk investment that may not be suitable for all investors.