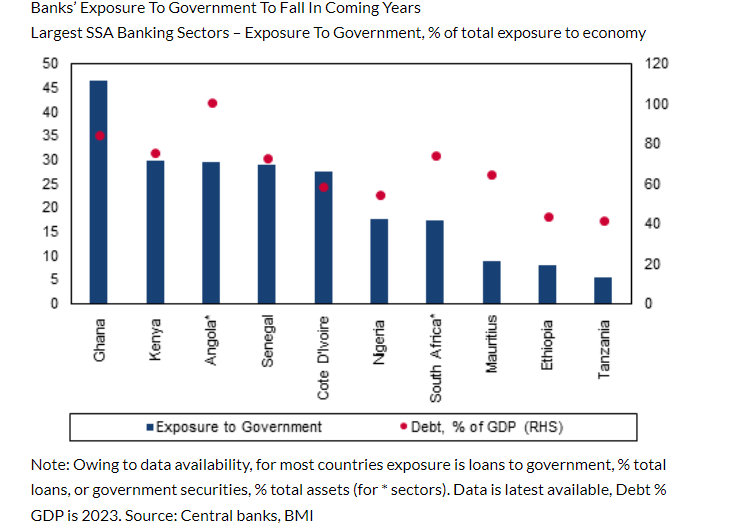

Ghana had the highest banks’ holdings of government debt in Sub-Saharan Africa in 2023, according to Fitch Solutions.

Regarding government debt to Gross Domestic Product (GDP), Ghana ranked second, just behind Angola.

Kenya, South Africa, and Senegal followed in third, fourth, and fifth places respectively.

The report highlighted that banks in Sub-Saharan Africa, including Ghana, will continue to face risks related to sovereign exposure throughout the forecast period. However, these risks are anticipated to decrease over time.

During the Covid-19 pandemic, banks’ holdings of government debt and claims on the public sector surged as governments increased borrowing to cover additional expenditures.

With limited access to international markets due to high costs, domestic banks became the primary financiers. This reliance poses significant risks to banks, particularly when government finances are under strain.

“This dependence poses significant risks to banks, particularly when government finances are strained. For instance, Ghana’s default on its domestic and external debt in December 2022 led to considerable losses for banks participating in its domestic debt exchange programme”.

“As can be seen in the chart below, banking sectors in markets with elevated levels of government debt typically have the highest exposure to the government through loans or government securities holdings. We expect that the average debt-to-GDP ratio for the region will fall in the coming years, after peaking in 2023, boding well for our view that banks will reduce exposure to the sovereign”, it stressed.

Reopening of Africa’s Eurobond market in 2024 marks positive shift

The report noted that the reopening of Africa’s Eurobond market in 2024, after more than a year of inactivity, signifies a positive development, with successful and oversubscribed bond issuances from countries like Côte d’Ivoire, Benin, and Kenya.

This revival, it stated, gives governments an alternative financing source beyond banks, allowing banks to reduce their exposure to sovereign debt and potentially free up resources for more lending to the private sector. However, this shift is anticipated to be gradual, given ongoing concerns about loan quality and the higher risk profiles of private sectors compared to sovereigns.