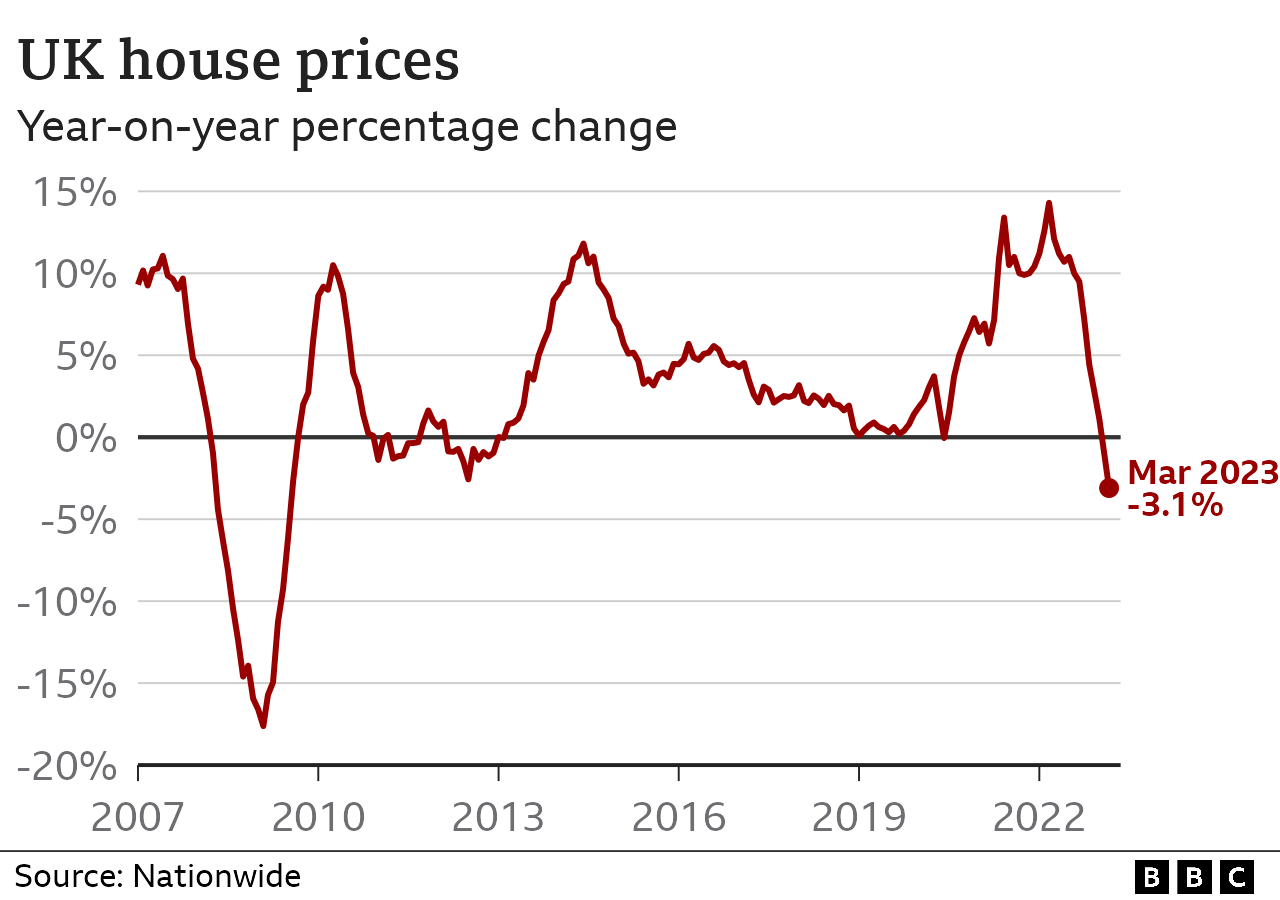

The UK’s most recent statistics show that house values dropped in March at their highest annual rate in 14 years.

The lender reported that prices had dropped 3.1% from a year earlier, which is the biggest yearly fall since July 2009.

Following the turmoil in the financial markets that followed the mini-budget, The Nationwide claimed that the housing market reached a “turning point” last year.

“Activity has been subdued” ever then, it was added.

“It will be hard for the market to regain much momentum in the near term, since consumer confidence remains weak and household budgets remain under pressure from high inflation,” said Robert Gardner, Nationwide’s chief economist.

A drop in house prices would generally be welcomed by potential first-time buyers, who have watched property values surge, even during the pandemic.

However, the reality is that renting has become more expensive for many people, and mortgage rates are higher than they might have planned for. The continuing rise in many regular bills and food prices are also adding to the financial strain.

The Nationwide’s findings, based on its own lending data, suggest prices have now fallen for seven months in a row. This echoes the general conclusion of other house price surveys and commentary, which show a slowdown in the sector and falling prices.

In March, the Office of Budget Responsibility – which advises the government on the health of the economy – predicted that house prices will drop by 10% between their peak last year and the middle of next year.

The Nationwide said that prices were already 4.6% below their peak, after taking seasonal factors into account.

Alice Haine, analyst at investment platform Bestinvest, said: “What is clear is that the red-hot property market of pandemic days – when buyers snapped up bigger homes in the race for space, aided by temporary stamp duty incentives – is now behind us, with buyers and lenders taking a far more conservative approach towards home ownership.”

Concern over mortgage rates is a major factor in the slowdown in the sector. Rates surged after last year’s mini-budget during the short-lived Liz Truss government.

Although the rates have dropped back partially since, a succession of base rate rises by the Bank of England have fed through – so interest rates on home loans are higher now than people became accustomed to in the past decade.

Although the UK’s housing market is made up of a series of local property sectors, the Nationwide’s regional breakdown for the first three months of the year suggested a slowdown across all areas of the country.

Source: BBC