OmniBSIC Bank has extended its profitability in one more quarter, with an impressive streak of gains that has now become part of the bank’s brand. The indigenous lender posted a gross profit of GH¢36.93million in the third quarter of this year to sustain its profit run and cement a turnaround that began in the first quarter of 2022.

The significant profit posted in the third quarter was contained in the bank’s financial statement published this week. It compares to a loss of GH¢10.44 million that the bank suffered in the same period last year, the statement showed.

This now makes it the third quarterly profit in a row by the bank after it posted its maiden profit of GH¢8.69million in the first quarter of this year. In the second quarter, OmniBSIC grew the profit significantly to GH¢25.04million before stretching it further to GH¢36.93million in the quarter under review.

Strategic business

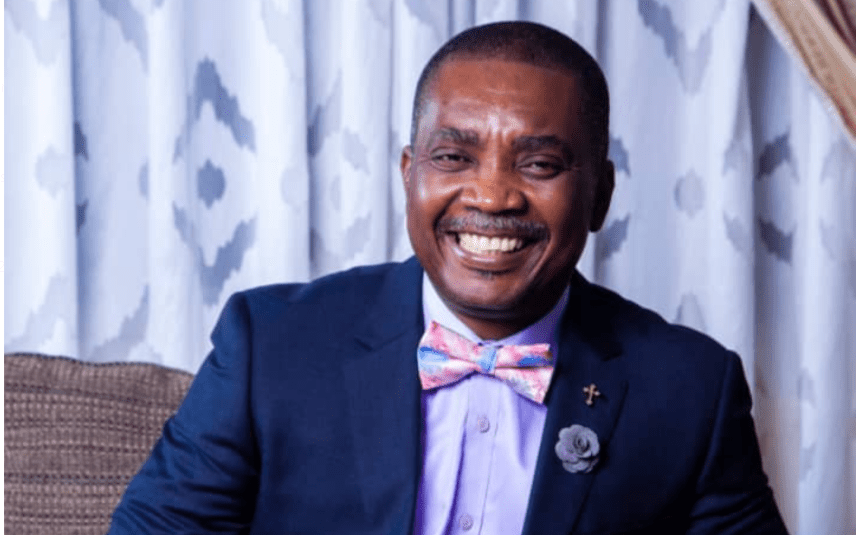

The Managing Director of OmniBSIC, Daniel Asiedu, said in an interview on October 13 that the higher profit was the result of hard work and commitment by the bank’s board, management and staff.

Mr. Asiedu is optimistic that the trend will continue into the fourth quarter for the bank to post its first annual profit.

He said the team at OmniBSIC has committed to offering exceptional products and services to customers, and that is now being rewarded with the strong performance. “We also look for strategic business opportunities, and that is what’s reflecting in the growth and performance,” Mr. Asiedu said.

He disclosed that the bank has gone live with its new robust core banking software – which is meant to make service to customers smoother, as it allows more integration with other applications.

Impressive performance

Beyond the consistent profit, OmniBSIC’s third quarter financial statements showed that the bank sustained its generally impressive performance.

All income lines enjoyed buoyant growth, with net trading income leading the pack. It rose from GH¢2.5million in the third quarter of 2021 to GH¢34.8million. Fees and commission income also almost quadrupled from GH¢8.4million in the third quarter of last year to about GH¢33.2million in the same period this year. Deposits from customers also rose from about GH¢1.2 billion in the third quarter of 2021, to almost GH¢2billion for the same period this year.

Strong balance sheet

The results further showed that OmniBSIC has maintained its strong balance sheet and liquidity position through buoyant growth in loans and advances, investments and cash balances with counterpart banks.

It showed that the bank’s support to the economy and businesses, in particular through loans and advances, rose from GH¢335.7million in the third quarter of 2021 to GH¢714.3million in the quarter under review.

While investments rose from GH¢847.9million to GH¢1.2billion in the quarter under review, cash and balances with other banks ended the quarter at GH¢543.8million – up from GH¢205.9million and indicating that OmniBSIC continues to be liquid.

Supporting business

A wholly-indigenous bank, OmniBSIC was launched in 2019 as the outcome of a merger meant to consolidate operations and serve customers better. It faced turbulence in its first years until late 2021, when the ingenuity of the board, management and staff started paying.

Mr. Asiedu, who is leading the turnaround, is an astute banker with indelible footprints at Zenith Bank Ghana Limited and the Agricultural Development Bank (ADB) where he was Managing Director. He said it is obvious that the bank has turned the corner, and is now keen on consolidating the performance to be able to support more businesses.

Uniqueness

Mr. Asiedu said the rising deposits also show that customers are happy with the bank’s services. He said due to the unique nature of OmniBSIC, it was able to meet the demands of all its customers on time – resulting in more referrals.

Throwing more light on the uniqueness, the Reverend Minister and Chairman of the International Presbytery of the Fountain Gate Chapel (FGC) said in the area of foreign exchange needs of their customers OmniBSIC was able to deliver upon request, and that led to higher businesses.

He therefore appealed to the general public and businesses in particular to endeavour to experience the bank by requesting its services and products in the outlets nationwide.

Source: BnFT