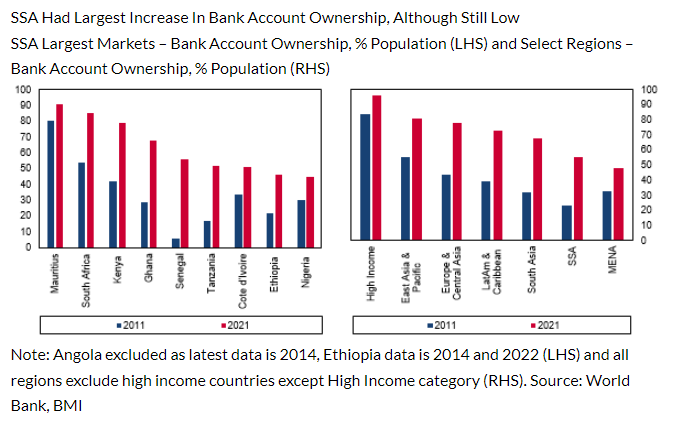

Ghana has been ranked 4th in Sub-Saharan Africa for the largest growth in digital bank account ownership, according to a report by Fitch Solutions.

The report revealed that the country experienced over 40% growth in digital bank accounts (including mobile money) between 2011 and 2022, bringing the total to a little over 60%.

Despite this progress, Fitch Solutions noted that the growth remains relatively low when compared to global peers. The top three countries in Sub-Saharan Africa are Mauritius with over 90% growth, followed by South Africa at 82%, and Kenya at 74%.

Following Ghana, Senegal took the 5th spot with 54%, with Tanzania, Ivory Coast, Ethiopia, and Nigeria ranking 6th to 9th respectively.

In its article titled “Navigating The Digital Banking Landscape In Sub-Saharan Africa”, the UK-based firm highlighted that while the Sub-Saharan Africa (SSA) region has lagged behind other areas in banking sector development, it has led the way in digital banking advancements.

“We estimate that SSA banking assets will represent 53.0% of Gross Domestic Product in 2024, compared to the emerging markets average of 84.8%. Limited access to traditional banking has hindered broader economic participation and growth,” the report stated.

The rise of digital banking, driven by factors such as the proliferation of mobile phones, improved internet connectivity, and increasing regulatory support, presents immense opportunities for financial inclusion, which is essential for economic development and technology adoption in the region.

Fitch Solutions added, “We anticipate that SSA will continue to develop its digital banking capabilities, benefiting households, businesses, traditional and challenger banks, and the broader economy. This article investigates key themes and challenges associated with digital banking in SSA, a topic we previously highlighted as influential in the region’s banking development.”

The report further highlighted that Nigeria and Kenya stand out as key hubs for digital banking in the SSA region, driven by a blend of traditional banks and innovative fintech companies. In Nigeria, institutions like Kuda Bank and GTBank are using mobile platforms to serve unbanked and underbanked populations.

Additionally, South Africa is recognized for its advanced financial infrastructure, while Ghana continues to surge in mobile money usage, and Tanzania experiences rapid growth in mobile banking.

These trends signify the potential for further digital banking development across Sub-Saharan Africa, with Ghana playing a crucial role in this transformation.