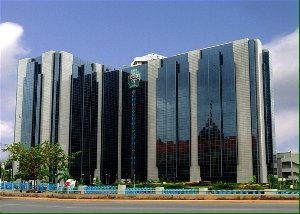

The Central Bank of Nigeria has given the green light for the merger between Providus and Unity Bank, with both institutions now awaiting the go-ahead from the Securities and Exchange Commission.

This approval from the CBN marks the first merger endorsed following the apex bank’s directive for financial institutions to bolster their minimum capital reserves. According to the CBN’s recapitalization guidelines, international commercial banks are required to raise their capital base to N500 billion, national banks to N200 billion, and regional banks to N50 billion.

The letter, titled “Re: Request for Merger Approval and Financial Support,” was a response to a previous correspondence dated June 19, 2024, in which permission for a merger and financial aid had been requested.

In addition to granting approval for the merger, the central bank also authorized a financial package of N700 billion for the newly formed entity, to be repaid at an interest rate of six percent.

According to the CBN, this financial support will be provided as a 20-year term loan, with repayment starting after a five-year grace period, though the source of the funds was not disclosed.

The letter obtained by our correspondent on Tuesday read, “Following a review of your letter, we write to inform you that the Central Bank of Nigeria has approved your request as follows:

“A financial accommodation totalling N700bn to the new entity, structured as a 20-year term loan. The loan will be priced at an interest rate of MPR minus 11 per cent, subject to a minimum of six per cent. Payments are to be made semi-annually, with a principal moratorium of five years. Beginning in the sixth year, the new entity will commence repayment in 15 equal instalments until maturity.

“Total obligation of Unity Bank amounting to N303.7bn (comprising N92.00bn of First Bank of Nigeria exposure on clearing obligation, N51.70bn financial accommodation of the CBN, N25.00bn Anchor Borrowers programme obligation and N135.00 billion NIRSAL obligation) will be deducted from the N700bn financial accommodation. The obligations to the CBN and NIRSAL will be settled accordingly.

“The balance of N396.30bn from the financial accommodation is to be invested in a 20-year Federal Government of Nigeria bond. The N396.30bn invested in the 20-year FGN bond will qualify as a Tier 2 capital instrument and component of the shareholders’ fund.

“Unity Bank’s current Cash Reserve Ratio shortfall of N117.90bn is hereby waived from being debited. Providus Bank’s CRR balance, post-merger, will serve as the opening balance of the new entity.”

The letter, however, noted that “These terms are subject to your acceptance and full compliance. Kindly confirm your acceptance of the outlined terms.”

Verifying the correspondence, the interim Director of Corporate Communications at the CBN, Hakama Sidi, in a release on Tuesday, noted that the central bank had approved the merger to enhance the resilience of Nigeria’s financial sector, prevent potential systemic threats, and avoid an outcome similar to the recent collapse of Heritage Bank.

The director, however, refrained from disclosing the financial support amount provided to the bank.