In the first three months of the year, the US economy slowed down as businesses scaled back their investments in response to rising borrowing costs.

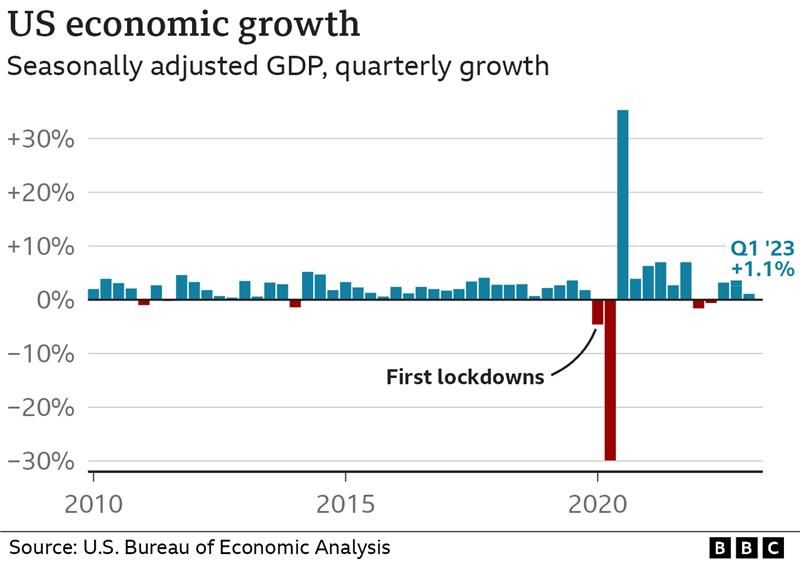

The economy grew 1.1% on an annualised basis, the Commerce Department said.

That was down from a rate of 2.6% in the prior quarter, despite strong consumer spending.

Analysts are watching nervously to see how the world’s largest economy handles a mix of higher interest rates and rising prices.

The latest report on gross domestic product – the widest measure of economic activity – showed the economy has now grown for three quarters in a row.

The US economy had contracted in the first half of last year as trade flows adjusted from the pandemic and higher borrowing costs led to a sharp slowdown in home sales.

But a strong job market has kept consumer spending – the main driver of economic activity – resilient, despite rising living costs, helping to defy predictions of a recession.

Spending was up 3.7% on an annual basis in the January-to-March period.

US President Joe Biden has cast the slowdown as a necessary adjustment after the boom following the reopening from the pandemic.

“Today, we learned that the American economy remains strong, as it transitions to steady and stable growth,” he said in a statement following the report.

However, many forecasters still expect the US to fall into economic recession sometime this year.

“Overall, the data confirm the message from other indicators that while economic growth is slowing, it isn’t yet collapsing,” said Andrew Hunter, deputy chief US economist for Capital Economics.

“Nevertheless, with most leading indicators of recession still flashing red and the drag from tighter credit conditions still to feed through, we expect a more marked weakening soon.”

The US central bank has pushed interest rates to more than 4.75%, from near zero last March, moving aggressively to try to slow the economy and ease the pressures pushing up prices.

Since the campaign started, inflation – the rate at which prices rise – has dropped back, falling to 5% in March, but it remains higher than the bank’s 2% target.

Meanwhile firms – especially in sectors such as housing, finance and tech where low borrowing costs had fuelled growth – have been growing more cautious.

Recent weeks have been marked by announcements of job cuts from many big businesses, including consultancy Deloitte, manufacturer 3M, retailer Gap and tech giant Meta.

Thursday’s report showed the biggest drop in business investment in equipment since the pandemic in 2020, falling 7.3% on an annual basis.

Analysts say they expect further pain ahead as the job market weakens and banks grow more wary of lending after a string of US bank failures last month.

Retail sales have already slowed since the start of the year and consumer confidence has taken a hit.

“GDP growth is being held up largely by the consumer at present, but growth in consumer spending appears to have lost momentum over the past month or two,” Wells Fargo economist Jay Bryson said.

“We forecast that the US economy to slip into recession, which we expect to be of moderate severity, in the second half of the year.”