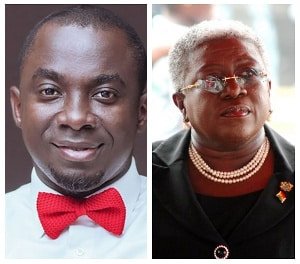

A report on the ongoing court case involving Gifty Afenyi-Dadzie’s First Africa Savings and Loans (FASL) and The Beige Group has highlighted contradictions in her statements to the police and the Receiver of Banks.

In a prior report by starrfm.com.gh, it was revealed that Gifty Afenyi-Dadzie, the former Managing Director of FASL, had informed the police that she was unaware of her husband, Kwesi Tetteh Dadzie, receiving a $1.5 million partial payment.

This case stems from the collapse of Beige Bank during the 2019 banking sector cleanup.

According to the details shared by the news portal, Gifty Afenyi-Dadzie’s statements to the police regarding her husband’s payment appear to be incorrect, considering her involvement in the agreement that made The Beige Group FASL’s majority shareholder.

The report also noted that in July 2017, Gifty Afenyi-Dadzie approached Mike Nyinaku, the Chief Executive Officer (CEO), to discuss FASL’s financial difficulties. At that time, FASL was facing significant liquidity challenges, struggling to meet its depositors’ demands. Consequently, Gifty Afenyi-Dadzie sought financial assistance from Michael Nyinaku.

“Thinking this was a temporary challenge and on the basis of the fact that Mike held her as a godmother, he gave her an amount of GHS200,000 (Two Billion old Cedis ) as a gift to augment her needs. Within a week of having given her the initial sum of GHS200,000 as a gift, Mrs. Afenyi Dadzie, approached Mike Nyinaku again requesting for more financial support for FASL.

“She explained that FASL had been given notice by the BoG that they were at risk of having their license revoked as a result of a continuous decline in their capital adequacy position. In principle, the company was in dire need of new capital injection far in excess of the initial amount gifted by Mike Nyinaku to GAD. Sensing that this could be a recurrent issue and considering his experience in the industry, Mike decided to make things more formal this time. Mike thus caused TBG to advance to First Africa Group, a loan of GHS200,000. This transaction was executed via a check dated August 8, 2017,” the report indicated.

According to the report, the two parties reached an agreement to address FASL’s persistent issues by having First Africa Group sell 90% of its stake to The Beige Group (TBG) for a value of USD 2.5 million.

Subsequently, the agreement was finalized, and an initial payment of $1.5 million was made to FASL in accordance with Clause 4.1 of the share purchase agreement. This clause stipulated that upon the payment of USD 1,500,000 of the purchase consideration, TBG would assume complete control of FASL.

Consequently, on September 4, 2017, TBG executed two installment payments to FAG, totaling GHS 7 million (equivalent to USD 1,589,684 at the time). The first payment of GHS 5 million (USD 1,136,519) was made on September 5, 2017, followed by the second payment of GHS 2 million (USD 453,165) on September 15, 2017.

As of September 15, 2017, TBG had fulfilled the crucial condition specified in the agreement, granting it the right to assume full control of FASL. Subsequently, TBG appointed Vanessa Atsu as the Responsible Officer, representing the new shareholders. Vanessa Atsu’s primary responsibility was to oversee the complete transition of FASL into a fully integrated subsidiary of The BEIGE Group.

Banking sector cleanup and the events that happened thereafter:

All bank accounts belonging to organizations connected to TBG were instructed to be frozen by the Receiver of Banks on August 1, 2018, the day the BEIGE Bank was taken over. As a result, FASL and all of TBG’s subsidiaries’ accounts were stopped.

Eventually, a few of the subsidiaries petitioned the Receiver to unfreeze their accounts because there were no legal justifications for this action. However, these appeals went unanswered.

Gifty Afenyi-Dadzie and another person by the name of Kwabena Osei Bonsu, who was then a manager at FASL, allegedly hired the Receiver of the BEIGE Bank to speak with The BEIGE Bank about the operations of FASL in order to get her accounts unfrozen.

“Kwabena Osei Bonsu in his statement to the Police indicated that the purpose for which he and GAD engaged the Receiver was for them to enquire about the status of the bank accounts of FASL held with the Beige bank. That meeting was held on August 15, 2018. It turns out that no official of The BEIGE Group – the then majority shareholders of FASL was informed about or invited to be in attendance at this meeting.

“It has further emerged that during that meeting, Mrs Gifty Afenyi-Dadzie and Kwabena Osei Bonsu presented themselves as officials of FASL to the exclusion of the representatives of The BEIGE Group who were the majority shareholders of FASL at the time. What was striking was that Vanessa Atsu, who had served as the representative of The BEIGE Group at FASL and the substantive person managing all the affairs of FASL was not invited to this meeting or even mentioned at the meeting by GAD and Kwabena Osei Bonsu,” the report added.

Also, it emerged that Afenyi-Dadzie told the Receiver at that meeting that TBG had only “expressed the intention to invest in FASL and consequently made a deposit for shares of GHS9M but the process was yet to be completed,” without the mention that prior to the investment of GHS9M into the company by BEIGE, an amount of GHS7M had already been paid by BEIGE to FAG, the outgoing shareholders to secure the shares that were being purchased.

The police Commercial Crime Unit (CCU) of the CID was notified of the situation by the Receiver of the BEIGE Bank, and an inquiry into it was then launched.

According to the report, Gifty Afenyi-Dadzie reiterated the information she had previously given to the Receiver when she appeared before the police, with the exception of the facts that the shares had actually been partially paid for directly to FAG and that full control of FASL had been transferred to The BEIGE Group in accordance with the terms of the share purchase agreement.

“What is not known is whether she provided a copy of the share purchase agreement to the police or not however, what is known without a shred of doubt is that she did not disclose that First Africa Group – the company of which Kwesi Tetteh Dadzie, her husband was the Managing Director – had received and acknowledged payment of an amount of GHS7M being part payment for the share purchase consideration agreed upon between the two parties.

“Secondly, the CID invited Mike Nyinaku. In a statement issued to the Police dated September 12, 2018, Mike Nyinaku narrated the entire story about how the acquisition happened, the purchase consideration of GHS7M paid, the additional capital injection of GHS9M made into the company, the appointment of BEIGE officials to manage the company, amongst others and supported all these with the relevant supporting documentation including a copy of the share purchase agreement,” the report added.

The police chose to confront GAD with the former’s side of the story after Mike Nyinaku also showed up and provided supporting evidence for the agreement between BEIGE and FASL, contradicting what GAD had told them on August 27, 2018.

“Thus, in a supplementary statement offered by Mrs. Gifty Afenyi Dadzie to the Police on September 25, 2018, she admitted that ‘After consulting her boss, he confirmed that the cedi equivalent of USD1.5M had been paid by BEIGE to First Africa Group as part payment of the purchase consideration of USD 2.5M agreed,’” it added.

Kwabena Bonsu, the fourth prosecution witness, who was a manager at FASL at the time, insisted he was unaware of the existence of a share purchase agreement between First Africa Group and The BEIGE Group while being cross-examined by Thaddeus Sory, the attorney for Mike Nyinaku in the ongoing trial.