Ghana faces an increased risk of cocoa smuggling after Ivory Coast’s recent decision to raise its farmgate cocoa price, overtaking Ghana’s rate. As the world’s top cocoa producer, Ivory Coast aims to curb illegal bean exports, but this move could significantly affect Ghana’s cocoa industry.

Ivory Coast’s Agriculture Minister, Kobenan Kouassi Adjoumani, announced in Abidjan that the farmgate price will rise by 20%, from 1,500 CFA francs (around GH₵40) to 1,800 CFA francs (approximately GH₵48) per kilogram, starting on October 1, 2024.

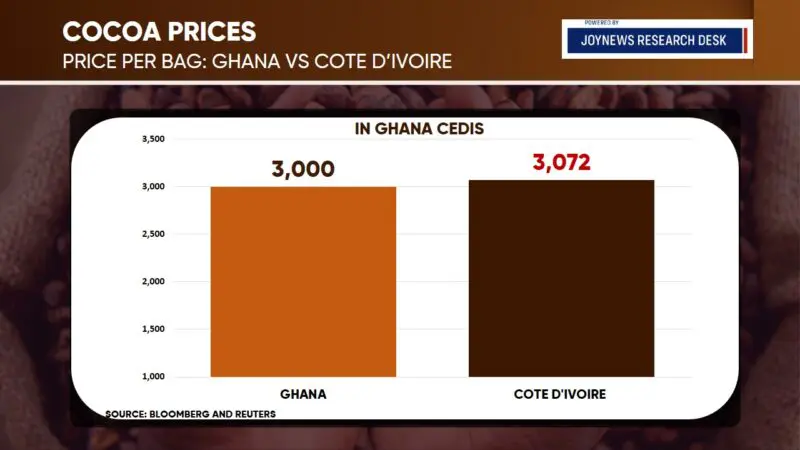

This increase means a 64 kg bag of cocoa will now cost about GHS 3,072, slightly higher than Ghana’s current price of GH₵3,000 per bag. The price adjustment is intended to deter cocoa smuggling into Ghana, though it may not entirely prevent illegal exports to other neighboring countries like Liberia and Guinea, where buyers offer prices closer to the global market rate.

During the 2023/2024 season, Ivory Coast reportedly lost between 150,000 to 200,000 tons of cocoa to smuggling, according to Bloomberg.

Implications for Ghana

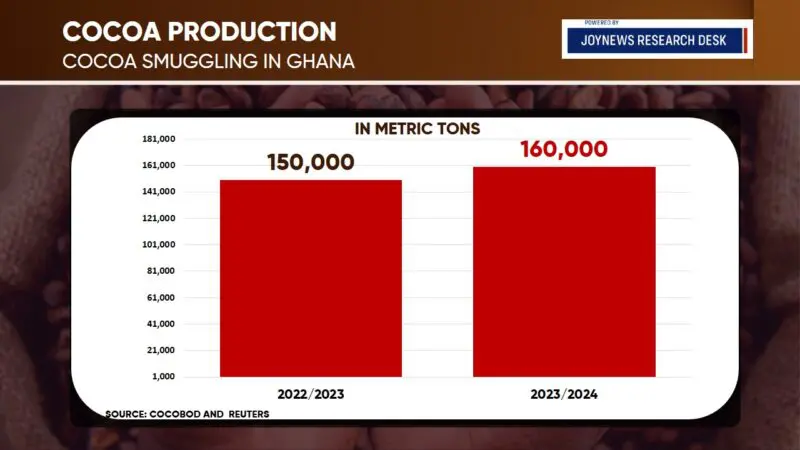

Ghana, the second-largest cocoa producer globally, has faced similar challenges. According to Reuters, low domestic prices and delayed payments have pushed some farmers to sell their cocoa to well-organized smuggling networks. In the 2023/2024 season, the country lost around 160,000 metric tons to smuggling, up from 150,000 tons the prior season.

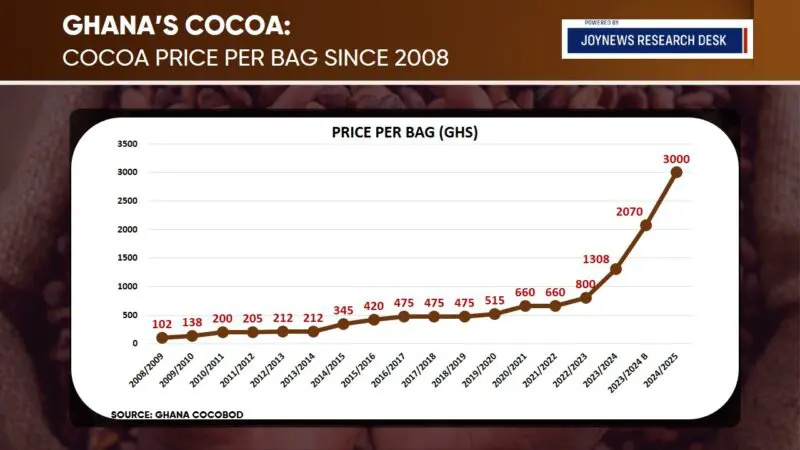

Ghana’s lower cocoa prices, compared to neighboring countries like Côte d’Ivoire—where the price per bag was approximately GHS 2,560 in the 2023/2024 season, GHS 490 higher than Ghana’s rate—led to increased smuggling.

In response, the Ghana Cocoa Board (Cocobod) raised the farmgate price by 45% for the 2024/2025 season, from GHS 2,070 to GHS 3,000 per 64 kg bag.

Ghana’s effort to curb smuggling by raising farmgate prices may fall short, as Ivory Coast’s recent price hike could undermine these measures. Their rates still present a more attractive opportunity for smugglers.

Ghana’s Production Dynamics

Low yields in Ghana and Ivory Coast have led to a four-year global cocoa supply shortage, pushing up cocoa and chocolate prices. However, Ghana has been unable to capitalize on these higher international prices due to widespread smuggling.

By June 2023, Ghana’s cocoa output had fallen to 429,323 metric tons, representing less than 55% of the average production for the same period in earlier seasons, marking the steepest decline in over 20 years.