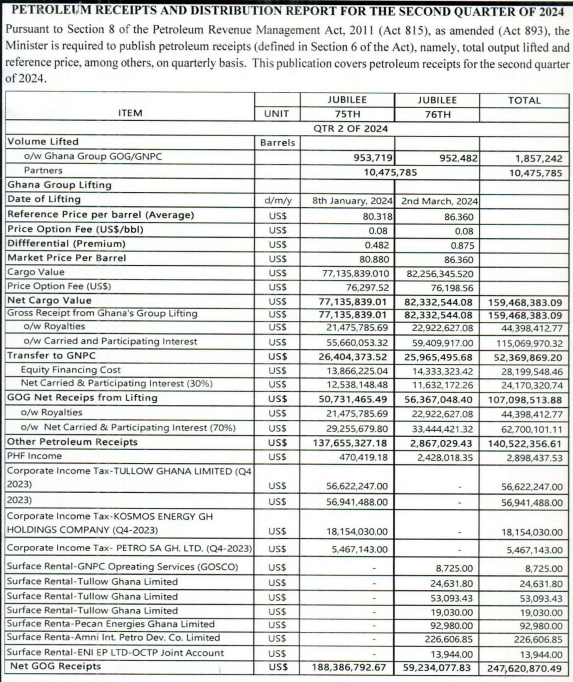

Ghana recorded a total of $247,620,870.49 in petroleum receipts for the second quarter of 2024, according to the Petroleum Receipts and Distribution Report.

The report, released by the Ministry of Finance, reflects oil revenues gathered from two separate liftings in the Jubilee oil field.

Key highlights from the report show that 1,857,242 barrels of oil were lifted during the quarter, divided between the 75th and 76th liftings. The average reference price for a barrel of oil during this period stood at $80.318 for the 75th lifting and $86.360 for the 76th lifting. The market price per barrel ranged from $77,135,889.01 in the 75th lifting to $82,256,345.20 in the 76th lifting.

Breakdown of Revenues

The Gross Receipts from Ghana’s group lifting totalled $159,468,883.09, with $71,135,889.01 attributed to the 75th lifting and $82,332,544.08 to the 76th lifting. From this, Royalties accounted for $22,475,655.73, and the Carried and Participating Interest contributed $115,069,970.32.

The Net Carried & Participating Interest (70%) provided a significant portion of these earnings, amounting to $47,655,527.18, in addition to other petroleum receipts totalling $140,522,365.31 for the quarter.

The Corporate Income Tax contributions from major players in the sector were also substantial, with Tullow Ghana Limited paying $56,622,407.40 and KOSMOS Energy contributing $18,154,030.00.

Government Receipts

The Government of Ghana received $107,988,517.30 in net receipts from the petroleum liftings, with $52,367,048.40 coming from the 75th lifting and $56,621,468.90 from the 76th lifting.

The report also detailed that surface rental payments made by companies, including Tullow Ghana Limited and PetroSea Operating Company, contributed a smaller portion of the total earnings, at $59,093.43 and $8,725.00 respectively.

Strategic Reforms and Future Prospects

As the Ministry of Finance continues to report on petroleum revenue transparently, the sector remains a key driver of Ghana’s economy. The financial performance during the second quarter demonstrates steady growth in the industry, while the upcoming quarters are expected to provide further insight into the strategic plans for Ghana’s oil sector, especially in light of regulatory reforms.

This robust financial performance highlights the critical role of oil revenues in supporting the government’s fiscal policy and infrastructural development.